Benjamin Franklin once said, “Money makes money. And the money that money makes, makes money.”

He was describing the concept of compounding interest.

Like a snowball rolling downhill, gathering size and speed with each rotation, compounding interest is the phenomenon that can transform small investments into substantial wealth over time — when interest is made on interest, not just principal. The bigger the “snowball” gets, the faster it moves, continues to grow and gains momentum.

A familiar example of compounding interest for many people is its negative impact on your debt, like unpaid credit card balances. When unpaid interest is added to the unpaid principal, you create a larger total for interest to compound. This is why it’s so important to only spend what you make, pay all interest on credit cards or loans and lower your outstanding balance. This gives you a double bonus, as interest does not get compounded and decreases over time, plus you have more available money to invest.

Your goal is to get compounding interest to work in your favor when you invest, and the beauty of it lies in its accessibility. Anyone, regardless of income or background, can harness its power. It’s one of the easiest ways to debunk the financial myth that you have to have “a lot” to create real wealth. With compounding interest, investing small amounts can add up over time, especially when you continue to invest incrementally.

How to take advantage of compounding interest

The two ingredients to compound interest are time and consistency. Let’s dive into each one.

- Start early

Time is your greatest asset when it comes to compounding interest, and the earlier you start, the more time your money has to grow. That’s why financial literacy and wellness are so important. The sooner you understand how much money you make, how you spend it, and what goals you need it for, the faster you can make investments that will turn into big gains for your future self.

In the previous series, we talked about how to establish a budget for the year. Let’s say you have $1,000 of available funds and decide to invest in a 401k or savings account that earns an average annual return of 7%. With compounding interest and without adding anything to it, over the course of 30 years, that initial investment would grow to approximately $7,612.

If we compare that to someone who decides to wait 10 years before investing the same amount, leaving them only 20 years to grow, their investment would reach around $3,869, yielding about half the returns. If you wait another 10 years, your growth will be reduced by almost half. Here’s the punchline: the longer your money has to compound, the greater the growth potential.

- Consistently add over time

Imagine that same $1,000 investment with an average annual return of 7%, but you commit to adding $500 to the pot every year. After 30 years, your investment would grow to approximately $43,800 — over five times what it would have been with the additional contributions. Said differently, $16,000 invested with compounding interest results in a cumulative return of almost 175%.

By consistently adding to your investment, you’re increasing the principal amount that’s compounding and taking advantage of the leverage from exponential growth potential over time. You’re continually fueling the compounding process.

Some great free online tools are available for calculating how compounding interest can impact your savings based on how much you have to invest, the interest rate, and the time you’ll give your investment to grow.

The key to retirement wealth

Compounding interest is an incredibly powerful tool when saving for retirement. Americans believe they need an average of $1.7 million to retire comfortably. To build this amount of wealth, you need to save early and consistently and make your money work for you.

Remember, saving the first dollar is often the hardest. When you set your contribution goal for your first year of saving, you will probably feel every dollar coming from your available funds. A good baseline to shoot for is to save about 5% to 10% of your total earnings. If you can do more over time, you will be well on your way to creating significant long-term wealth. Build this into your budget.

As you contribute to your 401(k) each year, you want to ensure your contributions auto-escalate or increase until you have reached the maximum annual contribution allowed by the IRS. When organizations also provide employer matches for 401(k) contributions, it’s a good practice to meet the match limitation available to you, giving a 100% return on invested funds that your employer matches — now that is a great return.

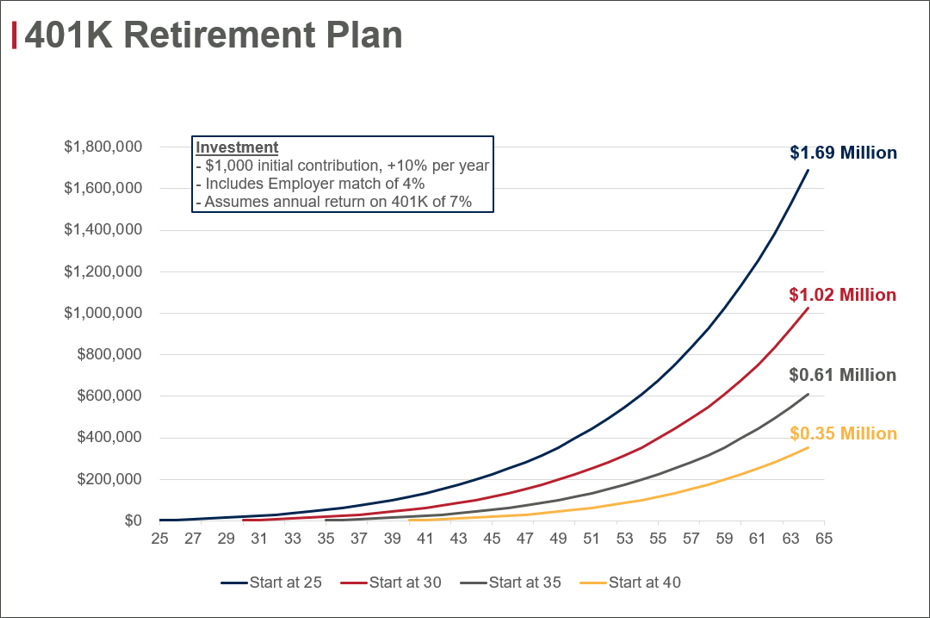

Here’s an example of what someone could save with an assumed $1,000 invested the first year: a contribution increase of 10% each year (until the maximum allowed by the IRS is attained), a 7% annual return, and a 4% company match over 25, 30, 35 or 45 years.

So how much should you be putting away and when? The 2024 contribution limit for 401(k), 403(b) and most 457 retirement plans is $23,000. That’s your goal. But if you can’t reach that limit — and many people cannot — contribute what you can afford and contribute it now.

Now is the time to get started to create meaningful wealth when you are ready to retire.