Financial Literacy Series #2: Don’t Spend More Than You Make

by Andy Watts, Executive Vice President & Chief Financial Officer at Brown & Brown Insurance

I strongly believe in the power of financial literacy. I wrote a blog on this topic in August, and based on the feedback, it was clear we needed to create a series to dig in further. Over the next year, I will share my point of view on multiple subjects under the umbrella of financial literacy to help each of us further develop this critical skill.

The idea of not spending more than you make seems obvious, but the Federal Reserve reports that almost 1 in 4 Americans do just that.

Of course, most didn’t plan to be in that situation. In most cases, it is a convergence of factors — inflation, lack of wage growth and high interest rates — that have made this trend more palpable. Generally, the real issue is excess discretionary spending, or spending money on things you want, not what you need.

Even if you aren’t spending more than you make, 1/3 of Americans wish they spent less in the past month. Are you one of them?

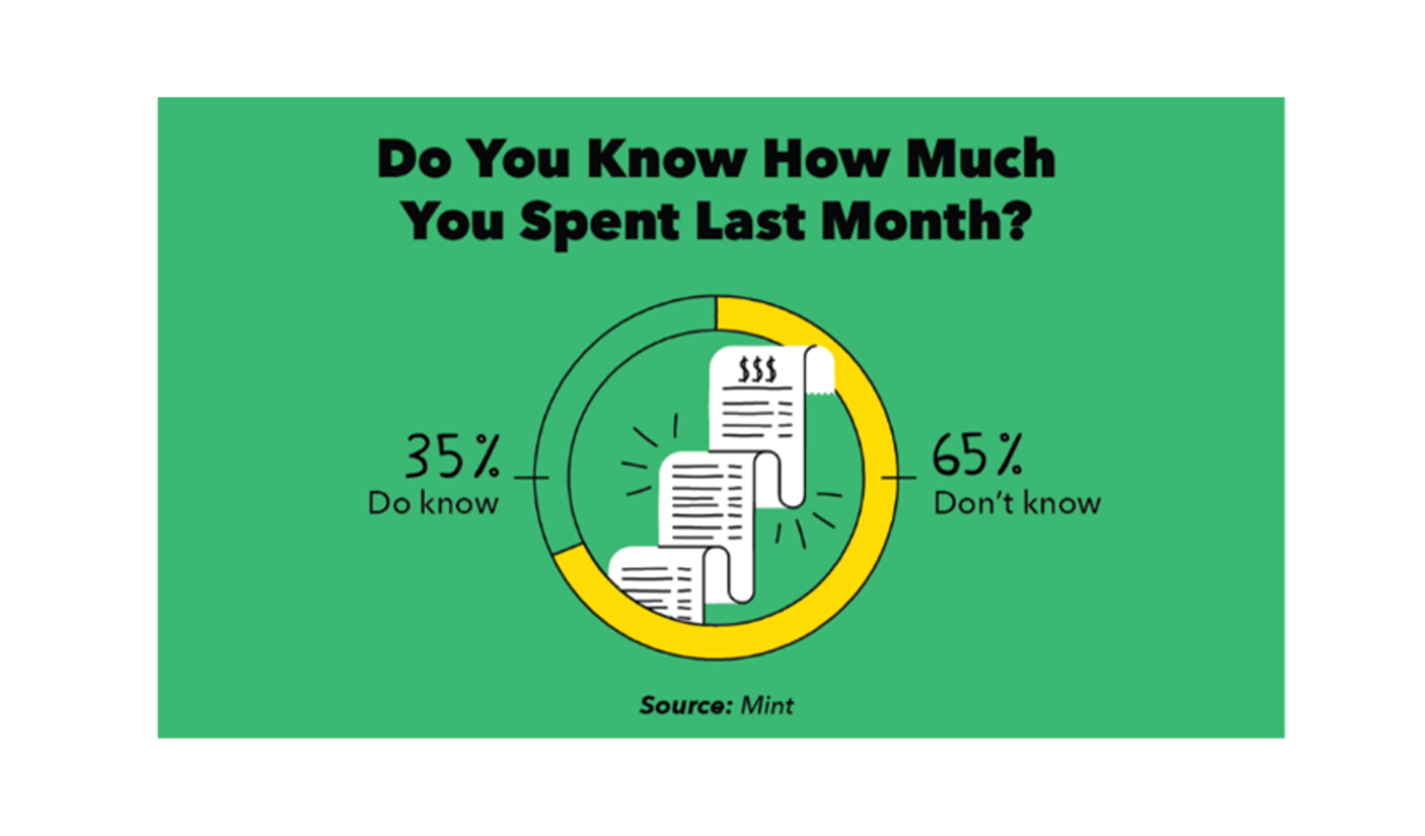

Statistics show that the younger people are, the less likely they are to have a handle on how much they spend. Only 23% of Gen-Z, for example, know how much they spend versus 27% of Millennials and 46% of Baby Boomers.

Financial literacy is so important for all ages and economic stages. Are you ready to take your finances into your own hands and become more financially literate?

If you spend it, track it

Keep in mind the old adage: “You can’t manage what you don’t measure.” The first step in getting your finances in order is determining your baseline. As many as 65% of Americans say they don’t know how much they spent last month.

You don’t have to be one of those people.

Below are three steps to get — and keep — you on track.

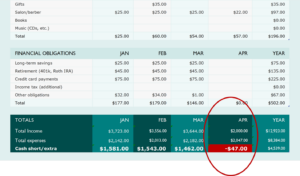

1. Take ownership of your money. This step is about getting organized. The first thing you need to do is create a personal tracking sheet. For three months, write down everything you spend money on. Everything. Utility bills, dry cleaning, parking, coffee, toiletries, you name it. And be sure to save all those receipts. The length of time — 3 months — is important because it establishes a routine. If you can do something for three months, you can do it long-term. To make it easier, you can use this spreadsheet.

If writing it down seems onerous, consider using your credit card to track it for you. Use your credit card for everything, then you can see on your monthly statement how much you’ve spent and in which categories: food, car, shopping, etc.

There is plenty of technology out there that can make this step more manageable, such as Mint, YNAB, Goodbudget and EveryDollar. NerdWallet even wrote a blog detailing some of the best budget apps. Find one that works for you.

(Example Outcome to Avoid!)

2. List out your income. Knowing what’s coming in and when is just as important as what’s going out. If you receive a regular paycheck, track when it comes in. This year, there are three months with five weeks. If you get paid every other week, you’ll be getting a paycheck more often, which makes a difference when it comes to cash flow. In addition to your full-time job, be sure to track any money coming in from side gigs. These are often irregular, so tracking is critical.

If your primary source of income is inconsistent, such as commissions or tips, as it often is for those working in sales or hospitality, round down when you estimate income. This will help in creating a more realistic budget. It’s always better to have a surplus at the end of a month versus not being able to pay a bill because you overestimated how much you would be making during that pay period.

3. Create a routine. Take time to track your income and expenses once a week. No one enjoys sitting down and paying bills at the end of each month; build a routine that has you staying on top of it more frequently. The only way to create a sustainable routine is to establish a strong pattern of taking action. Start slow, as if you were starting a new workout routine. Make a commitment to yourself and do it for three months. By then, it’ll feel habitual.

Next steps

Once you’ve tracked everything for three months, you will have a clear picture of where you are spending your money and in which categories you can reduce your outflow. Most importantly you will have the tools and knowledge to thoughtfully reduce your spending, so you are not spending more than you make.

With this information, you can now project your estimated income and expenses for the remainder of the year – with the goal of having a clear roadmap to better financial security. Good luck over the coming months – you can do it.

Evolving Finance

to Support Business Growth

with Andy Watts, Executive Vice President & Chief Financial Officer at Brown & Brown Insurance

Subscribe to Andy’s Evolving Finance monthly newsletter and view this blog on LinkedIn here.