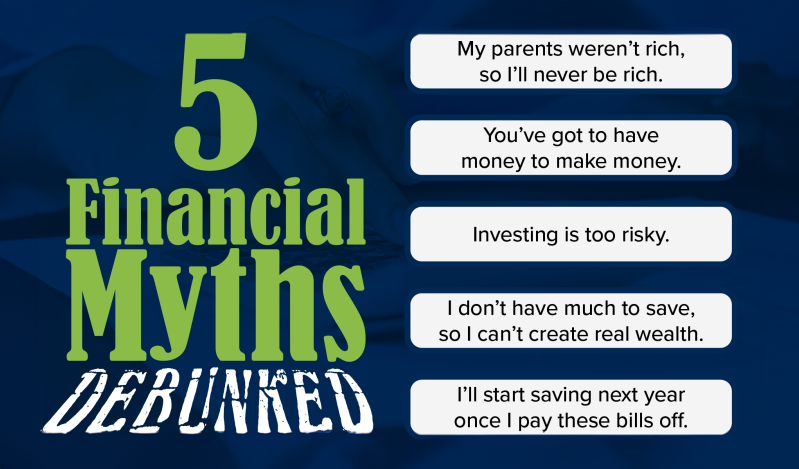

Financial Literacy Series #3: 5 Financial Myths Debunked

by Andy Watts, Executive Vice President & Chief Financial Officer at Brown & Brown Insurance

Money — and managing that money — makes many people uneasy. In fact, over 56% of adults in the U.S. feel anxious about their finances.

I believe a lot of that worry comes from people not understanding how finances work, which is also why we see the proliferation of financial myths replacing facts. What follows are some of the most common myths I hear people repeat and why those myths don’t match reality.

1. My parents weren’t rich, so I’ll never be rich.

People often think that they have little chance to accumulate wealth because they or their parents didn’t grow up with money. Privilege certainly comes with growing up wealthy, but that doesn’t mean wealth isn’t within your reach. You don’t need to be Bill Gates to be considered wealthy. Success and financial stability come in various forms.

Take a closer look at your extended family. Do you have an aunt, uncle or cousin who came from a similar background but managed to achieve financial success? Their experiences can serve as a testament to the fact that your upbringing doesn’t have to define your financial future.

Think about people you know from your hometown or high school who have made it financially. What did they do differently? What were their attributes, work habits and investing style? Learning from their success stories can inspire and guide you on your financial journey.

Consider the story of the founder of CDW, Michael Krasny. He started with a simple idea, selling an old computer, and turned it into a billion-dollar business. His story underscores the importance of entrepreneurship and seizing opportunities when they arise. Success often starts with a small step.

TIPS:

- Reach out to people who have achieved financial success. Many successful individuals are willing to share their experiences and offer advice. They can provide valuable insights into investing, saving and building wealth. They’ll likely tell you to invest in yourself by acquiring new skills and to live by the “pay yourself first” mentality of saving.

- Read books like The Millionaire Next Door, which highlights the principles of saving, investing in yourself and living within your means.

2. You’ve got to have money to make money.

This misconception can be a significant roadblock to financial growth, but it’s entirely possible to start investing with small amounts of money. You can invest as little as $25 in an S&P 500 index fund or a treasury bond fund. These are not overly complicated or sophisticated investments, offering a great entry point into the market.

Investing in savings doesn’t mean you have to go in and pick individual stocks and bonds; you can buy a mutual fund and have an investment manager do the complicated work of figuring out those investments. An investment manager can help you understand your risk profile and tailor your investments accordingly.

TIP:

- If you have access to a 401(k) retirement plan, make the most of it. These plans often offer a range of investment options. Contribute as much as you can and consider diversifying your investments within the plan. Plus, most 401(k) plans offer participants educational resources that you can use to build your knowledge and confidence.

3. Investing is too risky.

It’s true that investing carries some level of risk, but with risk often comes reward.

Different investments come with varying degrees of risk; choosing investments that align with your risk tolerance and financial goals is key. While there’s no such thing as a risk-free investment, you can manage and mitigate risk through diversification and a well-thought-out investment strategy.

Investing should always be viewed with a long-term perspective in mind. Historically, a diversified portfolio of equities has provided an average annual return of around 6% to 8% over the long term. This is much better than leaving your money in cash, where it can erode due to inflation.

Investing is not about trying to time the market perfectly. Attempting to predict market highs and lows is a risky endeavor. Instead, successful investing is often about moderation. By investing consistently over time and dollar-cost averaging, you can reduce the impact of market volatility on your portfolio.

TIP:

- While real estate can be a great investment opportunity, it can also be risky. It’s essential to thoroughly research the real estate market, consider your financial situation and exercise caution when making real estate investments. Buying at the top can be a great way to lose some of your hard-earned money.

4. I don’t have much to save, so I can’t create real wealth.

This is one of the biggest myths out there. The truth is that anyone can invest, and small amounts can add up to significant wealth over time.

For example, saving $5 per day with a 6% return can grow to over $200,000 in 30 years. Increasing your savings rate over time can lead to even greater wealth. Saving $1,000 per month at 6% can result in over $1 million in 30 years or $2 million in 40 years.

TIP:

- The first dollar saved is the hardest. But as you earn more, it becomes easier to increase your savings rate. Start early, and watch your wealth grow.

5. I’ll start saving next year once I pay these bills off.

Unfortunately, for most people, the plan to start saving “next year” often remains just that — a plan. Life has a way of bringing new financial obligations, and if you keep pushing off saving, you might find yourself constantly in catch-up mode.

If you tend to spend more than you make, waiting to pay off bills before saving may not lead to better financial habits. Discipline and budgeting are essential. Without them, you may continue to overspend.

TIPS:

- Everyone needs a rainy-day fund. Unexpected expenses can happen at any time. Even if it’s just $20 a week, an emergency fund can help you avoid dipping into your savings or debt when unexpected financial challenges arise.

- Remember to track where your money goes. Writing down your expenses helps you gain clarity on your financial habits, identify areas where you can cut back and allocate funds for savings.

- While treating yourself occasionally is OK, prioritize investing in yourself before splurging on luxury items or vacations. Building financial security, investing in your education or boosting your earning potential should come before non-essential spending.

Pave the Way for Success

Dispelling common financial myths is crucial to achieving financial stability and success. By recognizing that wealth is attainable regardless of background, starting with small investments, managing risk, and prioritizing savings and investments early on, individuals can pave the way to a more secure and prosperous financial future.

Stay tuned for my next installment in the financial literacy series next month: Building a budget and investing in yourself.

Evolving Finance

to Support Business Growth

with Andy Watts, Executive Vice President & Chief Financial Officer at Brown & Brown Insurance

Subscribe to Andy’s Evolving Finance monthly newsletter and view this blog on LinkedIn here.