Financial Outlook 2024: Navigating Choppy Waters

by Andy Watts, Executive Vice President & Chief Financial Officer at Brown & Brown Insurance

A rollercoaster of volatility, uncertainty, unexpected challenges and higher interest rates has marked the financial world over the past year. As we enter 2024, the landscape seems poised to remain a stormy sea of choppy waters, where the forces of the economy and workforce availability intertwined will create an unpredictable journey that will be difficult for unprepared businesses to navigate.

Preparing for the unexpected and integrating adaptability into your business’s strategic and capital allocation plans is crucial in this dynamic environment. Maintaining focus and agility will be the top order for 2024. Are you ready to pivot and adjust your course as needed to guide your business leaders through the challenges of this unpredictable market? By doing so, you will not only stay ahead of emerging pitfalls but also position your company and yourself to seize opportunities as they materialize on the horizon.

The year 2024 will present many growth opportunities for those who are proactive and well-prepared, enabling them to respond swiftly while others are still figuring out their next moves. Are you thinking about your chess piece move?

Here are 5 themes for 2024 that I think will be the primary axes that we all pivot off

As leaders within their organizations, financial professionals should consider the following five factors ahead of the upcoming year:

1. High interest rates require new tactics. We have become accustomed to very low interest rates for almost 10 years, have had unprecedented amounts of capital infused into the economy during COVID and have had millions of workers leave the workforce. These factors have driven significantly higher levels of inflation. While somewhat tamed, inflation still demands attention and, more than likely, high levels of interest rates as we head into 2024. A few underlying questions remain:

- How high will it go?

- How long will it stay at heightened levels?

- When will it start to come back down?

As business leaders, we must consider how inflation impacts labor and procurement costs and determine our ability to pass these costs on to consumers. If we cannot pass along the costs, how are we retooling our business processes to drive increased efficiency and maintain profitability in the face of these challenges?

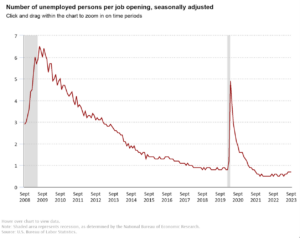

2. Labor availability is a key challenge. There continues to be a notable gap between the need for more people in the workforce and the available pool of workers. This is a consequence of the COVID pandemic in 2020, coupled with a period of rapid growth, resulting in 0.7 open job positions for every unemployed individual (see chart below). At the height, we had a shortfall of about 6 million jobs versus open positions.

The competition for talent remains fierce, and the ability to fill open roles is a challenge, prompting companies to innovate and enhance operational efficiency to bridge the labor gap. Finding creative solutions to secure the right workforce is essential for each company’s success but is also critical for the overall economic health of the country. How are you thinking about innovation to increase efficiency to meet the demands of your customers and grow your business?

3. Technology utilization is central to business goals. Organizations must leverage technology and data to enhance the customer experience and boost operational efficiency. This digital transformation will involve engaging artificial intelligence (AI) to amass data-driven insights and scale repeatable tasks. With a persistent labor gap, companies must embrace technology and ensure they have the data infrastructure to drive efficiencies. Key to this is having the right technology business partners to help you navigate the waters ahead. Capturing the power of technology will empower businesses to navigate economic fluctuations more effectively by automating essential functions and remaining resilient during slowdowns.

Organizations must ask themselves: Do we have the data we need to best run our company and understand our operations, customers and vendors? If not, what are we doing now to change the outcome for next year? In 2024, the strategic adoption of technology and data is central to business success in an ever-evolving landscape. Do you have the right team or advisors to help you create your plan?

4. Workforce upskilling requires intentionality. Rapid tech advancement requires a strategy for embracing innovation, enhancing efficiency and re-engineering processes. During times like this, businesses must incrementally invest in their teams, creating individualized plans to upskill each teammate’s growth and capabilities. How are you investing in your teammates to make them even better at what they do? Do you have a people plan for each person?

This need for upskilling applies to all — from those at traditional manufacturing companies to professional services firms, from smaller companies to Fortune 500 corporations — all organizations must seek the right talent to stay competitive in this tech-driven era. Workforce development will take center stage for businesses that want to thrive in 2024 and beyond.

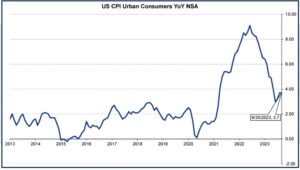

5. A post-COVID economy presents ongoing challenges. Before the pandemic, the Consumer Price Index had remained relatively stable for years (see below chart). However, the injection of $4.6 trillion into the economy led to a significant spending surge in the immediate post-COVID period. The index is gradually returning to a more stabilized range and historical levels, but debt balances are on the rise, as are increasing mortgage rates. With interest rates climbing, they pose a potential threat to economic growth as a meaningful percentage of our GDP in the United States. This, in turn, will impact mortgages and borrowing costs for businesses and consumers alike, which will then trickle down to developers and everyone in the construction supply chain, both residential and commercial.

In 2024, understanding and adapting to the evolving dynamics of the post-COVID economy will be essential for businesses looking to thrive in an environment marked by shifting economic variables.

Do you have a good feel for how your company will grow next year if GDP transitions back to more normal levels of 2%? What is your growth with GDP at 3.5%? Have you worked through your scenarios?

These factors collectively offer a glimpse into the challenges and opportunities for the year ahead, serving as precursors to a potential economic slowdown or continued resiliency.

As business leaders, the crucial questions we must grapple with include how we position and invest in our businesses, foster workforce development, embrace technology and effectively navigate the choppy waters of uncertainty. Adapting and thriving in this dynamic environment demands a proactive and agile approach, ultimately defining success in the ever-evolving economic landscape of 2024.

Evolving Finance

to Support Business Growth

with Andy Watts, Executive Vice President & Chief Financial Officer at Brown & Brown Insurance

Subscribe to Andy’s Evolving Finance monthly newsletter and view this blog on LinkedIn here.